Financial Peace of Mind: Affordable Tax Planning in Memphis, Tennessee

Managing taxes effectively is one of the most crucial parts of running a successful business or household. Whether you’re an entrepreneur, real estate investor, or professional in Memphis, smart tax planning can make a significant difference in your bottom line. But many individuals and small businesses avoid it, assuming expert services are expensive.

At CCN Business Consulting, we’re redefining that perception. Our approach to affordable tax planning in Memphis, Tennessee focuses on providing professional expertise at a fair cost — helping clients maximize savings without compromising quality.

Understanding the Importance of Tax Planning

Tax planning is the strategic management of your finances to legally minimize tax liabilities. It goes far beyond annual tax preparation. It involves anticipating future obligations, aligning business structures, and taking advantage of credits and deductions throughout the year.

Without proactive planning, you might be overpaying taxes or missing out on valuable opportunities. Effective tax planning ensures that your financial decisions — from investments to expense management — are optimized for tax efficiency.

For growing Memphis businesses, this can be the difference between breaking even and achieving sustainable growth.

Why Memphis, Tennessee Needs Smart Tax Planning

Memphis is one of Tennessee’s fastest-growing economic centers. From logistics and healthcare to real estate and small businesses, the city’s diverse economy creates unique tax challenges.

While Tennessee does not have a state income tax, there are still several layers of taxation — including franchise and excise taxes, local business taxes, property taxes, and federal requirements. This makes professional tax planning crucial for compliance and financial health.

With affordable tax planning in Memphis, Tennessee, you can navigate this landscape strategically — ensuring your business meets every legal obligation while keeping more of what you earn.

The CCN Business Consulting Approach to Affordable Tax Planning

At CCN Business Consulting, we believe that quality financial advisory services should be accessible to every business, not just large corporations. Our Memphis clients benefit from a results-driven model focused on clarity, transparency, and long-term value.

We deliver tailored tax planning services that reduce liabilities, streamline operations, and create sustainable financial strategies. Our advisors stay up to date with IRS updates and Tennessee regulations, ensuring that you’re always in compliance and ahead of potential changes.

What Makes Our Tax Planning “Affordable”

Affordability at CCN Business Consulting doesn’t mean cutting corners — it means maximizing value. Here’s how we keep our services both high-quality and cost-effective:

- Customized Packages: Clients only pay for what they need. Whether you require one-time planning or year-round advisory, we tailor packages to your budget.

- Remote Consultations: We minimize overhead through digital consultations and document sharing, passing those savings to you.

- Efficient Technology: Automated tools streamline bookkeeping and reporting, reducing time and labor costs.

- Transparent Pricing: No hidden fees — you know exactly what you’re paying for before we start.

- Long-Term Value: Our strategies save clients far more in taxes than the cost of the advisory itself.

That’s the essence of affordable tax planning in Memphis Tennessee — professional results at a reasonable price.

Core Tax Planning Services We Offer in Memphis

CCN Business Consulting provides comprehensive tax solutions that help individuals and businesses plan smarter, spend wisely, and grow confidently.

1. Strategic Tax Planning

We analyze your income, assets, and structure to design a plan that reduces your overall tax liability. Our Memphis advisors ensure you take full advantage of deductions, credits, and timing strategies that align with your goals.

2. Business Entity Structuring

Choosing the right business structure — LLC, S-Corp, or partnership — can significantly affect your taxes. We help you determine the most cost-efficient setup based on your business size, income, and growth projections.

3. Real Estate Tax Planning

Memphis is rich in real estate opportunities, but investment taxes can be complex. Our advisors guide you through 1031 exchanges, depreciation, cost segregation, and capital gains planning to preserve more of your profits.

4. Compliance & Reporting

Staying compliant with local, state, and federal regulations is critical. We ensure all filings are accurate and on time, minimizing audit risk and avoiding penalties.

5. Year-Round Advisory

Tax planning isn’t seasonal. We provide ongoing advisory services, helping clients make informed financial decisions throughout the year based on their evolving goals.

Explore our full list of services to see how we support businesses across different industries.

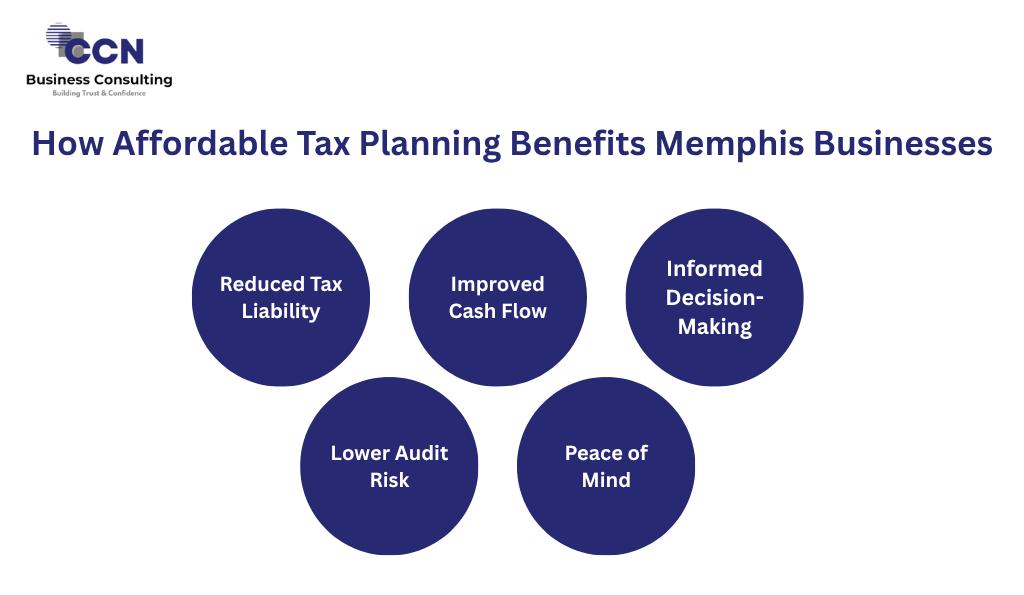

How Affordable Tax Planning Benefits Memphis Businesses

Businesses in Memphis that embrace proactive, affordable tax planning often see measurable results. The benefits include:

- Reduced Tax Liability: Identify legitimate deductions and credits to minimize the amount owed.

- Improved Cash Flow: Plan expenditures strategically for better liquidity.

- Informed Decision-Making: Use tax insights to guide business expansion or investments.

- Lower Audit Risk: Accurate reporting and proactive planning reduce the chance of red flags.

- Peace of Mind: You can focus on your core business, knowing experts are managing your tax strategy.

These benefits extend beyond the numbers — they give business owners confidence and control over their financial future.

Memphis Tax Landscape: Challenges and Opportunities

Memphis businesses face a distinctive combination of federal, state, and municipal tax considerations. Understanding these layers is essential for building a sound strategy.

- Franchise & Excise Taxes: Tennessee’s 6.5% excise tax and 0.25% franchise tax affect most businesses with net earnings or net worth in the state.

- Local Business Taxes: Memphis requires business licenses and imposes local business taxes based on activity type and revenue.

- Property & Sales Taxes: Proper reporting of property values and sales tax compliance are crucial for retailers and real estate firms.

- IRS Updates: Frequent federal tax law changes impact deductions, credits, and depreciation schedules.

By partnering with CCN Business Consulting’s experts in affordable tax planning in Memphis Tennessee, you can stay compliant and capitalize on every available incentive.

Common Mistakes Businesses Make Without Professional Planning

Skipping or delaying professional tax planning often leads to avoidable issues such as:

- Overpaying due to missed deductions or credits.

- Incorrect entity choice increases overall liability.

- Poor recordkeeping leading to audit exposure.

- Timing errors — reporting income or expenses inefficiently.

- Lack of future planning, resulting in higher taxes later.

At CCN Business Consulting, our proactive approach ensures you never face these challenges alone. We integrate your accounting, budgeting, and compliance into one strategic system for long-term stability.

Our Process: Simple, Transparent, and Effective

Our method for delivering affordable tax planning is built around collaboration and clarity:

- Consultation: We begin by understanding your business structure and tax concerns.

- Analysis: Our team reviews your past filings, financials, and future goals.

- Customized Plan: We create a tax-saving roadmap that fits your operations and budget.

- Implementation: You receive actionable steps with our guidance at every stage.

- Ongoing Review: We continuously monitor changes in tax law to keep your plan effective.

This step-by-step system ensures you always know what’s happening and why.

Affordable Tax Planning for Individuals in Memphis

Tax planning isn’t only for businesses — individuals in Memphis also benefit greatly from our services. Whether you’re a freelancer, real estate investor, or salaried professional, we help you minimize liabilities and plan for the future.

Our advisors assist with retirement planning, capital gains, charitable contributions, and deductions for education, home ownership, or investments. Personalized, affordable planning means you get professional results without the corporate price tag.

Integrating Tax Planning With Accounting and Fractional CFO Services

At CCN Business Consulting, we don’t just stop at tax planning. Our Accounting Services ensure accurate recordkeeping, while our fractional CFO solutions provide high-level strategic oversight.

Together, these offerings create a complete financial ecosystem. By aligning your accounting and tax functions, we ensure seamless reporting, faster decision-making, and greater financial efficiency.

Case Study: How Affordable Tax Planning Created Value

A small logistics firm in Memphis came to CCN Business Consulting facing high quarterly tax bills and inconsistent cash flow. After reviewing their financials, we restructured their entity, optimized expense timing, and leveraged Tennessee tax credits for small businesses.

Within 12 months, they reduced their annual tax liability by 18% and improved cash flow stability. This example shows that affordable tax planning in Memphis, Tennessee isn’t about cheap services — it’s about intelligent strategies that generate tangible returns.

Why Choose CCN Business Consulting in Memphis

Here’s what makes our Memphis tax planning services stand out:

- Experienced advisors with national and state-level expertise.

- Transparent, affordable pricing models.

- Personalized strategies tailored to each client.

- Long-term partnerships focused on growth and compliance.

- Proven track record of saving clients time and money.

Our approach isn’t transactional — it’s transformational. Every decision we make is designed to support your success.

Stay Informed With Expert Financial Insights

Knowledge is power in financial management. We publish regular insights and updates on our Blogs, where you can find valuable information about tax laws, accounting practices, and financial strategies. Stay connected to stay ahead.

Get Started With Affordable Tax Planning in Memphis, Tennessee

Your path to smarter finances starts with one conversation. Whether you need business or personal tax guidance, affordable tax planning in Memphis Tennessee from CCN Business Consulting can help you achieve clarity, compliance, and confidence.

Don’t wait until tax season to take control. Schedule a consultation today to discover how professional planning can pay off year after year.