Tax Filing Assistance in Memphis, Tennessee: Your Complete Guide

Filing taxes can be a stressful task, especially if you are unsure about deductions, compliance, or recent IRS regulations. For many individuals and businesses, working with professionals offering tax filing assistance in Memphis, Tennessee can make the entire process smoother, more accurate, and less time-consuming. In this blog, we’ll explore why tax filing matters, the benefits of professional assistance, the services available in Memphis, and how to choose the right partner for your needs.

Why Proper Tax Filing Matters

Accurate tax filing is not just about submitting forms; it’s about financial responsibility. When your taxes are filed correctly, you avoid penalties, interest charges, and potential legal complications. The IRS can impose strict penalties for even small errors, so proper documentation and compliance are essential.

Beyond compliance, tax filing also impacts your financial future. Filing correctly ensures that you receive all the refunds and credits you are entitled to. For families, small businesses, and individuals in Memphis, maximizing deductions can significantly reduce tax burdens.

Proper tax filing also builds financial credibility. Whether you are applying for a loan, expanding a business, or looking for an investment partner, lenders and stakeholders often review tax records to assess financial stability. If you’re new to our firm, learn more about our background on the About Us page.

Challenges of Filing Taxes on Your Own

Many Memphis residents consider filing taxes independently, especially with online tools. However, there are several challenges to this approach.

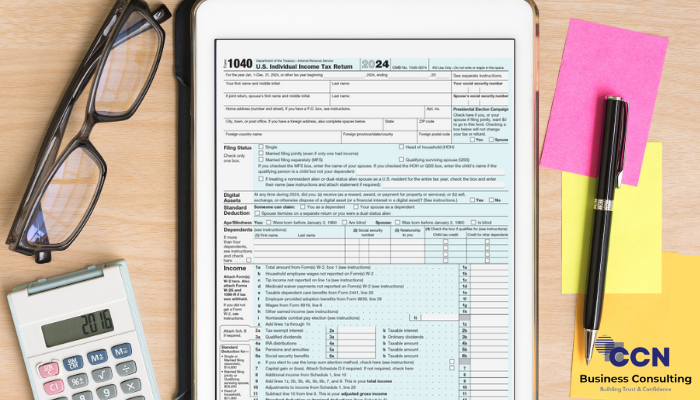

First, tax codes change frequently. Without up-to-date knowledge of IRS regulations, it’s easy to miss key deductions or make filing mistakes. Even small errors, such as incorrect Social Security numbers or math miscalculations, can delay refunds or trigger audits.

Second, tax filing requires organizing complex documentation. From W-2s and 1099s to expense receipts, investment forms, and business statements, the paperwork can be overwhelming. Self-filers may overlook important forms, leading to incomplete filings.

Finally, self-filing taxes can be stressful. For people with busy schedules, managing tax deadlines alongside personal or business responsibilities is difficult. This often results in rushed filings, which increase the likelihood of mistakes. Explore more financial insights on our Blogs page.

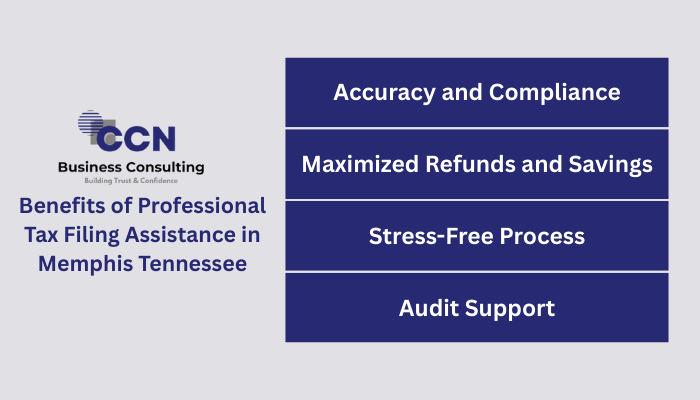

Benefits of Professional Tax Filing Assistance in Memphis, Tennessee

Working with professionals for tax filing assistance in Memphis, Tennessee offers several advantages.

- Accuracy and Compliance – Certified tax preparers ensure that every detail is accurate, reducing the risk of penalties. Their knowledge of tax codes helps you stay fully compliant with federal and state regulations.

- Maximized Refunds and Savings – Professionals identify deductions and credits that you may not be aware of. For example, business owners in Memphis can claim deductions for equipment, utilities, and office expenses, while individuals may qualify for education credits or child tax credits.

- Stress-Free Process – Delegating tax filing gives you peace of mind. Instead of worrying about forms and deadlines, you can focus on running your business or spending time with family.

- Audit Support – If the IRS audits your filing, having a professional by your side is invaluable. They provide documentation and representation, ensuring the audit process is managed effectively.

Our Services page highlights these and other solutions we provide to clients in Memphis.

Tax Filing Assistance for Individuals in Memphis

Individual taxpayers often think their taxes are simple, but professional assistance can still make a big difference. For employees, experts ensure accurate W-2 reporting and uncover deductions for things like student loans, medical expenses, and charitable donations.

Self-employed individuals, freelancers, and gig workers in Memphis face more complexity. They must manage 1099s, business expenses, and quarterly estimated taxes. Professional assistance ensures these filings are accurate while minimizing taxable income legally.

Retirees and seniors in Memphis also benefit from expert filing services. Professionals help manage retirement income, Social Security benefits, and required minimum distributions (RMDs) while ensuring tax efficiency. To see how this applies to you, explore our Services in detail.

Tax Filing Assistance for Businesses in Memphis

Businesses face greater tax complexities than individuals, making professional assistance essential. Whether you run a small local shop, a startup, or a larger corporation in Memphis, accurate tax filing impacts financial health and growth potential.

Business tax filing involves payroll, employee benefits, operating expenses, and sometimes multi-state compliance. For example, companies with remote workers outside Tennessee must navigate varying state tax laws. Professional services ensure compliance across all jurisdictions.

Additionally, professional tax assistance can help Memphis business owners plan strategically. Through tax planning, businesses can reinvest savings into growth opportunities such as hiring, marketing, or upgrading equipment.

If you’re ready to streamline your business taxes, visit our Contact Us page to connect with a tax professional today.

How Technology Has Changed Tax Filing Assistance

Technology has transformed the way tax professionals assist clients in Memphis. Instead of relying solely on paper records, many firms now use cloud-based accounting software to streamline filing. This improves accuracy and allows clients to access records securely anytime.

E-filing has also reduced turnaround times for refunds. Instead of waiting weeks, Memphis taxpayers who file electronically with professional help often receive refunds within days.

Tax professionals also leverage advanced tools for compliance checks. These tools highlight missing forms, incorrect calculations, or unusual deductions, reducing the chances of errors before filing. Learn how CCN Business Consulting uses technology-driven processes on our About Us page.

Choosing the Right Tax Filing Assistance in Memphis, Tennessee

With many options available, choosing the right professional for tax filing can be overwhelming. Here are some factors to consider:

- Credentials and Experience – Look for Certified Public Accountants (CPAs) or certified tax preparers who have proven expertise. Their knowledge of federal and Tennessee tax laws is crucial.

- Reputation and Reviews – Check client reviews, testimonials, and business ratings to ensure reliability. Reputable firms in Memphis often have long-term clients who return each year.

- Range of Services – Choose professionals who offer more than just filing. Tax planning, bookkeeping, and payroll support provide added value.

- Accessibility and Communication – A good tax preparer should be easy to reach, responsive to questions, and willing to explain complex details in simple terms.

To see how our firm meets these requirements, check our Services page.

The Role of CPAs in Tax Filing Assistance

Certified Public Accountants (CPAs) play a key role in offering advanced tax filing support in Memphis. Unlike basic preparers, CPAs undergo rigorous training and exams to gain expertise. They can represent clients during IRS disputes, audits, and appeals.

For businesses, CPAs act as strategic advisors. Beyond filing, they help with tax-efficient business structures, financial forecasting, and compliance planning. This makes them invaluable partners for long-term financial success. Learn more about our experienced team on the About Us page.

Common Tax Filing Mistakes in Memphis

Even with professional help, it’s important to be aware of common mistakes that taxpayers often make.

- Missing Deadlines – Filing late can result in hefty penalties and interest. Professionals ensure timely submission.

- Incorrect Deductions – Claiming ineligible deductions is a common error that can trigger audits.

- Mathematical Errors – Even minor miscalculations can delay processing and refunds.

- Failure to Report Income – Not reporting freelance or rental income can lead to compliance issues.

Avoiding these mistakes is much easier with the support of CCN Business Consulting. Get in touch via our Contact Us page.

Why Memphis is a Growing Hub for Tax Professionals

Memphis has become a hub for financial and tax services due to its thriving economy and diverse population. The city is home to small businesses, healthcare professionals, entrepreneurs, and logistics companies — all of which need reliable tax support.

As a result, demand for tax filing assistance in Memphis, Tennessee continues to grow. With an increasing number of professionals entering the market, residents and businesses now have access to highly specialized expertise. For insights on finance and tax trends, browse our Blogs.

How CCN Business Consulting Can Help

At CCN Business Consulting, we provide tailored tax filing assistance in Memphis, Tennessee for individuals and businesses. Our team of experienced tax preparers and CPAs ensures accuracy, compliance, and maximum financial benefits for every client.

Whether you are filing personal taxes, running a small business, or managing complex corporate accounts, we simplify the process. Our services also include bookkeeping, payroll management, and strategic tax planning, giving you a complete financial solution.

Final Thoughts

Filing taxes doesn’t have to be stressful. With professional tax filing assistance in Memphis, Tennessee, individuals and businesses can enjoy peace of mind, accurate filings, and maximum savings. From avoiding errors to strategic planning, tax professionals ensure that you’re financially secure today and in the future.