CPA Memphis: Your Trusted Partner for Tax, Accounting, and Business Consulting

Running a business or managing personal finances in Memphis, Tennessee, requires more than just balancing numbers. From navigating IRS regulations to planning long-term growth, the financial world can be overwhelming without the right guidance. That’s where a CPA in Memphis becomes an invaluable partner.

Certified Public Accountants (CPAs) are licensed professionals trained to handle complex tax, accounting, and business consulting needs. Whether you are an entrepreneur, a small business owner, or an individual with multiple income streams, hiring a CPA in Memphis ensures compliance, accuracy, and financial peace of mind.

What Is a CPA and Why Do You Need One in Memphis?

A Certified Public Accountant (CPA) is more than just an accountant. CPAs have passed rigorous state licensing exams and continue their education regularly to stay updated on tax laws and financial regulations. Unlike general accountants, CPAs can represent clients before the IRS, perform audits, and provide advanced consulting.

In Memphis, a CPA can help with:

- Preparing and filing accurate tax returns.

- Advising on financial strategies for business growth.

- Managing payroll, bookkeeping, and audits.

- Ensuring compliance with Tennessee and federal tax regulations.

If you’ve been searching for CPA Memphis, it likely means you’re looking for professional expertise to handle finances correctly and efficiently.

Why Memphis Businesses and Individuals Rely on CPAs

1. Local Knowledge with State and Federal Expertise

Memphis businesses deal with both Tennessee state rules and federal regulations. A local CPA understands these intricacies and helps you navigate them without costly mistakes.

2. Tax Planning and Preparation

From small startups to established corporations, tax preparation can be overwhelming. A CPA doesn’t just file returns—they create strategies to minimize tax liability and maximize deductions.

3. Business Growth Support

CPAs act as trusted advisors. Beyond numbers, they provide insight into budgets, cash flow, and expansion strategies that help Memphis entrepreneurs scale their businesses effectively.

4. Financial Peace of Mind

Whether you’re an individual or a business owner, financial errors can lead to penalties, audits, or lost opportunities. Hiring a CPA ensures your finances are in expert hands.

Services Provided by a CPA in Memphis

A CPA offers a wide range of services that go beyond basic accounting. Here are some of the most common areas where businesses and individuals rely on them:

1. Tax Services

- Individual and business tax preparation.

- Tax planning for future savings.

- IRS representation during audits or disputes.

- Filing multi-state or complex returns.

2. Bookkeeping and Payroll

Accurate bookkeeping and payroll services are essential for compliance and employee satisfaction. A CPA ensures your records are up to date and your staff is paid correctly.

3. Business Consulting

Memphis CPAs often act as consultants, helping businesses manage budgets, reduce costs, and plan for sustainable growth.

4. Financial Audits and Assurance

CPAs provide assurance services to verify financial statements, ensuring credibility with investors, lenders, and stakeholders.

5. Estate and Retirement Planning

For individuals, CPAs assist with wealth management, retirement accounts, and estate planning, helping you secure your financial future.

CPA vs. Accountant: What’s the Difference?

It’s common for people to use “CPA” and “accountant” interchangeably, but they aren’t the same.

- Accountant – May have a degree in accounting and handle basic financial tasks such as bookkeeping and tax preparation.

- CPA – Has passed a state licensing exam, meets continuing education requirements, and is authorized to perform more complex services, including audits and IRS representation.

If you’re looking for advanced expertise and credibility, hiring a CPA in Memphis is the right choice.

How a CPA Benefits Small Businesses in Memphis

1. Saves Time and Reduces Errors

Business owners already wear many hats. By delegating financial responsibilities to a CPA, you reduce errors and free up time to focus on growth.

2. Improves Tax Efficiency

CPAs help you identify deductions and credits that lower your tax bill, ensuring you keep more of your hard-earned money.

3. Provides Financial Forecasting

Small businesses in Memphis benefit from CPAs’ ability to create budgets and forecasts, helping owners make informed decisions.

4. Ensures Compliance with Laws

With changing tax codes and regulations, CPAs keep your business compliant, reducing the risk of penalties and audits.

Why Hire a Local CPA in Memphis Instead of a National Firm?

While large firms may seem appealing, local CPAs offer advantages that national chains often cannot match:

- Personalized Attention – Local CPAs know their clients personally and tailor solutions to their specific needs.

- Community Understanding – Memphis CPAs understand the local economy, industries, and market challenges.

- Accessibility – With a local office, it’s easier to meet face-to-face and build trust.

- Affordability – Local firms often provide high-quality services at more competitive rates.

How CCN Business Consulting Helps as a CPA Partner in Memphis

At CCN Business Consulting, we provide expert financial services that go beyond traditional accounting. Our team includes Certified Public Accountants who work with Memphis individuals and businesses to provide reliable, personalized, and strategic financial solutions.

Here’s what sets us apart:

- Comprehensive Services – From tax preparation to bookkeeping and payroll, we cover all aspects of financial management.

- Local Expertise – Based near Memphis, we understand Tennessee laws and the specific needs of local businesses.

- Personalized Approach – We don’t believe in one-size-fits-all. Every client receives tailored solutions.

- Proven Track Record – With years of experience, we’ve built long-term relationships with clients across multiple industries.

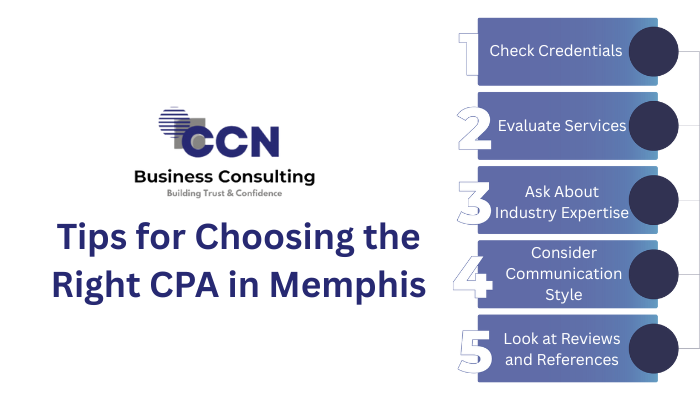

Tips for Choosing the Right CPA in Memphis

- Check Credentials – Ensure the CPA is licensed in Tennessee and has relevant experience.

- Evaluate Services – Look for a CPA who offers comprehensive support, not just tax filing.

- Ask About Industry Expertise – Some CPAs specialize in industries like healthcare, construction, or retail.

- Consider Communication Style – Choose someone who explains financial matters clearly and is available when needed.

- Look at Reviews and References – A CPA with positive testimonials provides confidence in their reliability.

Common Questions About CPAs in Memphis

1. Do I need a CPA or can I just use tax software?

Tax software works for simple returns, but CPAs provide personalized strategies, compliance assurance, and representation if issues arise.

2. How much does a CPA in Memphis charge?

Costs vary depending on the complexity of services. Many businesses find the savings from CPA expertise far outweigh the fees.

3. Can a CPA help with IRS audits?

Yes. CPAs are authorized to represent you before the IRS and can handle disputes on your behalf.

4. Is a CPA only for businesses?

No. Individuals also benefit from CPAs for tax filing, estate planning, and retirement strategies.

Final Thoughts

A CPA in Memphis is more than just a financial professional—they’re a trusted advisor who helps you navigate taxes, plan for growth, and achieve financial stability. Whether you’re a self-employed freelancer, a growing business, or an individual planning for retirement, working with a CPA provides clarity, compliance, and confidence.

If you’re ready to partner with a reliable CPA Memphis expert, CCN Business Consulting is here to help. With our certified professionals, local knowledge, and commitment to excellence, we’ll ensure your financial future is in safe hands.