Individual Tax Preparation Services Detroit: A Complete Guide for Stress-Free Filing

Tax season can feel overwhelming for individuals in Detroit, whether you’re a salaried employee, freelancer, or small business owner. The paperwork, changing IRS rules, and fear of missing deductions can easily cause stress. That’s why Individual Tax Preparation Services Detroit are more than just a convenience—they’re a necessity. At CCN Business Consulting, we specialize in helping individuals prepare accurate tax returns, maximize refunds, and stay compliant with both state and federal tax laws.

In this blog, we’ll break down why professional tax preparation matters, the benefits you gain, and how Detroit residents can take advantage of CCN Business Consulting’s expertise.

Why Individual Tax Preparation Services Are Important

Filing taxes isn’t just about filling in forms—it’s about understanding financial opportunities. Many Detroit taxpayers miss out on valuable deductions or credits because they don’t know all the rules. Professional tax preparers ensure accuracy, save time, and reduce the risk of IRS penalties.

By choosing Individual Tax Preparation Services Detroit, you’re not only reducing stress but also investing in your financial well-being. A well-prepared return can save you hundreds or even thousands of dollars each year.

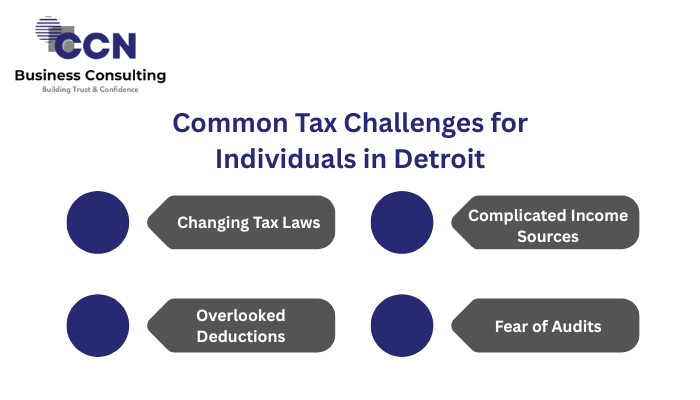

Common Tax Challenges for Individuals in Detroit

Individuals in Detroit face unique challenges when filing taxes. Some of the most common ones include:

- Changing Tax Laws – IRS rules evolve every year, and keeping up can feel like a full-time job. Without professional help, many Detroit taxpayers accidentally overlook new credits or face compliance issues due to outdated information.

- Complicated Income Sources – Freelancers, gig workers, and contractors often receive multiple 1099s, making tax filing complex. Without clear records, income reporting mistakes can trigger IRS red flags.

- Overlooked Deductions – Many individuals miss out on savings from medical bills, charitable donations, or education expenses. These small missed deductions add up, costing Detroit residents significant money over time.

- Fear of Audits – A simple filing error can increase the risk of IRS scrutiny. Professional preparation minimizes mistakes, giving you confidence that your return is audit-ready.

Our Individual Tax Preparation Services Detroit are designed to address these issues head-on, so you can file with peace of mind.

Benefits of Hiring Professional Individual Tax Services in Detroit

There are clear advantages to working with a professional tax consultant. Here’s how it helps:

- Accuracy and Compliance – Mistakes on tax returns can lead to costly penalties. A professional preparer ensures that every number is correct and that your return complies with both Michigan and federal tax rules.

- Maximized Refunds – Tax experts know where to look for savings. By analyzing your income and expenses, they identify deductions and credits you might otherwise overlook, ensuring you get back every dollar you deserve.

- Time-Saving – Preparing your own taxes can take days of gathering documents and double-checking forms. Hiring a professional saves you hours, letting you focus on work and family instead of paperwork.

- Audit Support – If the IRS ever questions your return, having a professional who understands the filing inside out provides security. They can represent you, respond to notices, and protect you from unnecessary stress.

- Personalized Advice – No two tax situations are alike. Professionals tailor their strategies to your circumstances—whether you’re a student, investor, or retiree—helping you plan smarter for future years.

With CCN Business Consulting, you don’t just file a return—you gain a financial partner who helps you maximize every opportunity.

Who Needs Individual Tax Preparation Services Detroit?

While everyone benefits from professional help, certain groups in Detroit find it especially valuable:

- Freelancers and Contractors – Self-employed workers must manage invoices, expenses, and quarterly tax payments. Professional services ensure deductions like home office, travel, and equipment costs are properly claimed.

- Students and Graduates – Education credits, tuition deductions, and student loan interest can reduce tax liability. A professional makes sure young adults don’t miss out on these valuable savings.

- Homeowners – Mortgage interest, property taxes, and energy-efficiency credits all play into a homeowner’s return. Professional preparation helps maximize these deductions while ensuring proper documentation.

- Investors – Reporting dividends, rental income, and capital gains requires precision. A mistake can mean overpaying taxes or facing penalties, but experts ensure accuracy.

- Salaried Employees – Even W-2 earners benefit. Work-related expenses, retirement contributions, and healthcare deductions are often overlooked without guidance.

Our Individual Tax Preparation Services Detroit ensure that whatever your background, your taxes are filed with accuracy and care.

The Process of Individual Tax Preparation at CCN Business Consulting

We make tax filing simple for Detroit residents by following a structured process:

- Initial Consultation – We begin with a one-on-one meeting to understand your income sources, financial history, and personal goals. This helps us tailor strategies to your situation.

- Document Review – You’ll provide essential forms such as W-2s, 1099s, receipts, and bank statements. Our team carefully reviews them to ensure nothing is overlooked.

- Analysis and Planning – Before filing, we analyze possible deductions, credits, and tax-saving opportunities. This proactive step ensures you pay less and keep more.

- Accurate Filing – Once your return is finalized, we file electronically to speed up refunds and avoid delays. Every detail is double-checked for accuracy.

- Ongoing Support – Unlike seasonal preparers, we’re available year-round. Whether you receive an IRS letter or need planning for next year, we remain your trusted partner.

This step-by-step process ensures you’re never left guessing during tax season.

How Tax Preparation Differs for Detroit Residents

Detroit residents face specific challenges beyond federal taxes. Michigan has a flat income tax rate, but local Detroit city taxes can complicate filings. Many taxpayers aren’t sure how to balance state, city, and federal requirements, which leads to errors.

Our experts in Individual Tax Preparation Services Detroit understand these rules and apply them correctly, ensuring compliance across all levels. This local expertise saves you from confusion and prevents costly mistakes.

Avoiding Mistakes with Professional Tax Help

DIY tax filing often seems like a cost-saving choice, but mistakes can lead to lost refunds or penalties. Common errors include:

- Incorrect Information – Small details like entering the wrong Social Security number or bank account details delay refunds. A professional ensures accuracy at every step.

- Misreporting Income – Freelancers and gig workers often forget to include certain 1099 forms. This oversight can result in IRS notices and unexpected tax bills.

- Overlooked Credits – Education credits, child tax credits, and retirement deductions are frequently missed by self-filers. Professionals help claim all eligible savings.

- Charitable Contributions – Many Detroit residents donate to local causes but forget to track receipts. A professional ensures these contributions are properly documented and deducted.

By working with CCN Business Consulting, you avoid these pitfalls and file with confidence.

Individual Tax Preparation for Freelancers and Contractors in Detroit

Freelancers and contractors make up a growing part of Detroit’s workforce. However, managing their taxes can be overwhelming. Our services include:

- Income Tracking – We consolidate income from multiple clients and projects, ensuring nothing is missed. This avoids underreporting, which could trigger audits.

- Expense Management – From laptops and software to travel and home office costs, we categorize every eligible expense. This reduces taxable income and saves money.

- Quarterly Payments – Freelancers must pay estimated taxes throughout the year. We calculate these payments accurately, so you’re never caught off guard with a large bill in April.

- Self-Employment Tax Reduction – Independent workers face additional taxes, but smart strategies can reduce this burden. We help structure finances to ease the impact.

Our Individual Tax Preparation Services Detroit ensure freelancers keep more of their earnings while staying compliant.

Individual Tax Preparation for Families in Detroit

Families in Detroit juggle childcare, school expenses, and household bills, which all affect tax returns. We provide:

- Child Tax Credit Assistance – Families often qualify for significant savings per child, but documentation must be precise. We ensure you claim the maximum amount.

- Earned Income Tax Credit (EITC) – Many working families miss out on this powerful credit. Our experts check eligibility to ensure you don’t leave money on the table.

- Childcare Deductions – Daycare, after-school care, and babysitting expenses can often be deducted. We guide families through the requirements to secure savings.

- Education Credits – College tuition, textbooks, and related expenses may qualify for credits like the American Opportunity Credit. We maximize these opportunities.

With our services, Detroit families save money while filing stress-free.

The Role of Bookkeeping in Accurate Tax Filing

Good bookkeeping is the foundation of accurate tax returns. Without organized records, deductions can be missed, and errors are more likely. At CCN Business Consulting, we integrate Bookkeeping and Tax Services for individuals in Detroit.

This approach ensures all income and expenses are documented properly throughout the year. By the time tax season arrives, your records are complete, accurate, and ready for filing—eliminating last-minute stress.

Why Choose CCN Business Consulting for Individual Tax Preparation Services Detroit

Detroit offers many tax preparers, but CCN Business Consulting is different:

- Local Expertise – We understand Michigan and Detroit-specific tax rules, ensuring compliance at all levels.

- Comprehensive Services – Beyond tax preparation, we also provide bookkeeping, payroll, and consulting, creating a one-stop financial solution.

- Tailored Support – Every client’s financial situation is unique, and we customize our approach to meet your needs.

- Audit Protection – If the IRS contacts you, we provide professional representation, reducing stress and protecting your rights.

- Year-Round Availability – We’re not just here in April. We guide Detroit residents with planning, advice, and support all year long.

When you search for Individual Tax Preparation Services Detroit, our team delivers more than numbers—we deliver peace of mind.

Steps to Get Started Today

Getting started with us is simple:

- Contact Us Online – Visit CCN Business Consulting to schedule a consultation. Our team is always ready to listen.

- Provide Your Documents – Securely upload your tax forms and financial records so we can review them thoroughly.

- Let Us Handle the Rest – We prepare, review, and file your return while keeping you updated at each step.

- Enjoy Peace of Mind – With your taxes in expert hands, you can focus on your life and work stress-free.

Tax season doesn’t have to feel overwhelming—with our help, it becomes effortless.

Final Thoughts

Filing taxes in Detroit can be complicated, but it doesn’t have to be stressful. By choosing Individual Tax Preparation Services Detroit from CCN Business Consulting, you gain expert guidance, accurate filing, and long-term financial benefits. Whether you’re a freelancer, family, homeowner, or investor, our team is here to maximize your savings and protect your peace of mind.Ready to simplify tax season? Visit CCN Business Consulting today and book your consultation with our tax experts.