Year-End Planning for Rental Property Owners: What to Do Before December 31

Owning rental real estate offers many advantages – consistent income, appreciation potential, tax-deductible expenses and depreciation benefits. But these potential advantages don’t just happen automatically. As we approach the end of the calendar year, there’s a finite window of time to take action so that the tax- and business-strategy you’ve been building actually pays off.

At CCN Business Consulting, we work with property owners to ensure they aren’t just doing things “the right” way — they’re doing things in the right time frame. The steps you take now (before December 31) can determine whether you capture these benefits for this tax year — or force you to wait another year.

In this post we’ll cover:

- Why year-end planning matters for rental properties

- The key action items you should address now

- Common missteps to avoid

- A checklist you can use to navigate your year‐end planning

Why Year-End Planning Matters for Rental Property Owners

When you own one or more rental properties, you’re not just managing a building — you’re managing a business. And like any business, timing influences your results. Here are a few reasons why the final quarter of the year is critical:

- Many tax-savings opportunities only work if the transaction or event occurs before December 31 (so that it’s reflected in the current year’s tax return).

- Your record-keeping and bookkeeping for the year need to be in order so that you can identify deductions, depreciation, and structural issues before you file.

- Evaluating performance now gives you time to make adjustments for next year — e.g., decide whether to sell underperforming assets, upgrade systems, change financing, or reposition properties.

- If you delay major decisions until after year-end, the benefit may shift into the next tax year — which sometimes means lost opportunity if tax rates or rules change.

In short: the “year-end” isn’t just a date on the calendar — it’s a deadline for action.

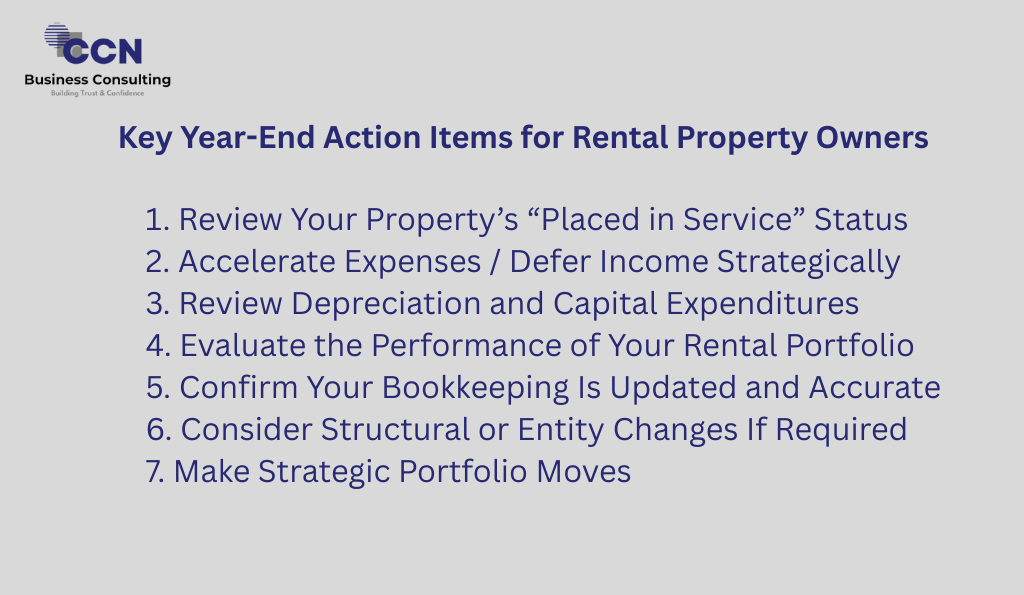

Key Year-End Action Items for Rental Property Owners

Here are some of the most important items you should address by year-end if you own rental properties:

1. Review Your Property’s “Placed in Service” Status

If you acquired new rental real-estate this year, ensure that the property is ready and available for rent before December 31. If it’s not placed in service, certain deductions (like depreciation) may not begin until next year.

Even for improvements or renovations, knowing exactly when “placed in service” occurs is vital.

2. Accelerate Expenses / Defer Income Strategically

If you expect high taxable income this year, consider whether you can shift deductible items into the current year (prepay insurance, maintenance, repairs). This lets you reduce this year’s tax burden.

For example: repairs are deductible in the year paid; improvements must be depreciated over the property’s life. Timing when you incur and pay these items matters.

3. Review Depreciation and Capital Expenditures

Depreciation is one of the most powerful tax advantages of rental property ownership. Review whether you have additional capital expenditures or cost-segregation opportunities this year. For improvements placed in service by December 31, you may capture more of the deduction this year rather than next.

4. Evaluate the Performance of Your Rental Portfolio

Now’s a good time to run the numbers: occupancy rates, expense variances, cash flow, debt service coverage. Did your properties meet your performance targets? If not, what needs to change next year? Use those insights to plan for upgrades, rent increases, or property disposals.

5. Confirm Your Bookkeeping Is Updated and Accurate

Clean books before year-end help ensure you don’t miss deductions, don’t misclassify expenses, and are prepared for your tax filings. Mistakes or last-minute chaos often lead to missed opportunities.

6. Consider Structural or Entity Changes If Required

If you’re operating multiple properties, consider whether your structure (LLC, partnership, S-Corp, etc.) is optimized. Also think about how your rental activity is classified (passive vs active). Some status changes may require action by December 31.

7. Make Strategic Portfolio Moves

If there are underperforming properties, tax‐inefficient assets, or upcoming market changes, consider whether you should sell, renovate, refinance or re‐leverage before year’s end (or at least plan it). This can affect your tax outcome and your performance for next year.

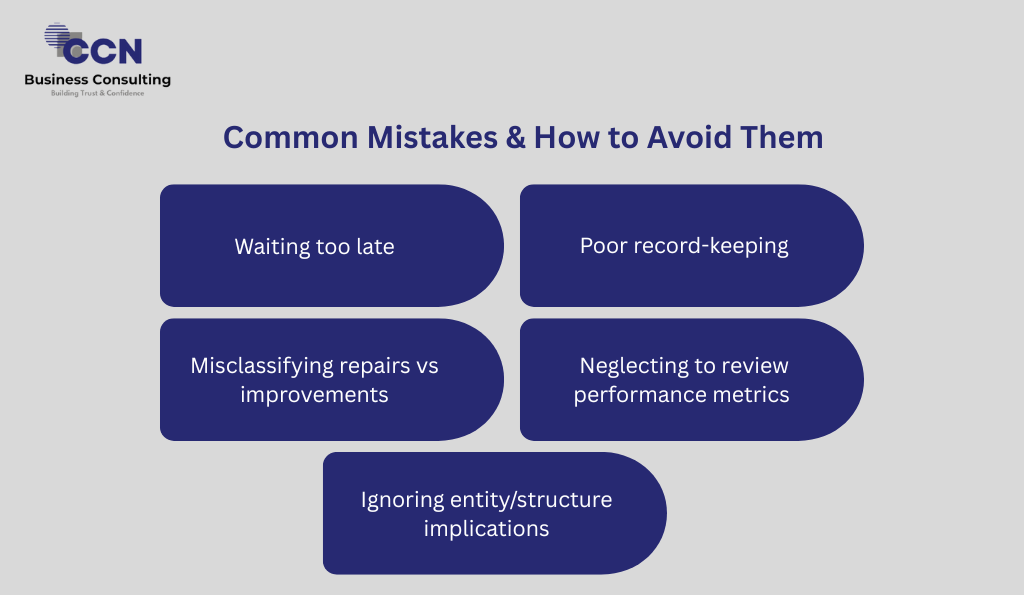

Common Mistakes & How to Avoid Them

Even savvy property owners can slip up. Here are common mistakes we see — and how you can avoid them:

- Waiting too late — assuming you can make big changes after December 31 and still capture this year’s benefits. Many deductions or classifications don’t allow that.

- Poor record-keeping — lacking documentation for repairs, improvements, material participation hours etc., often invalidates deductions.

- Misclassifying repairs vs improvements — thinking all expenses are immediately deductible when some must be capitalised and depreciated.

- Neglecting to review performance metrics — failing to see when a property is lagging until it’s too late to act.

- Ignoring entity/structure implications — rental activity classification or entity choice can matter for tax treatment; leaving it until tax-filing time may limit your options.

Final Thoughts

If you own rental property, your job isn’t over just because you collected rent and paid expenses. As the calendar year comes to a close, the decisions you make now can determine whether this year’s return is strong — or whether you leave money on the table.

At CCN Business Consulting, we partner with rental-property owners to ensure every strategic move is timed properly, every structure is optimized, and every deduction is captured. If you haven’t yet started your year‐end planning, now is the time — because once December 31 passes, many options expire.

Let’s make sure you head into the new year not just with a building, but with a business that’s optimized.