How Strategic Timing Can Maximize Bonus Depreciation and Section 1202 (QSBS) Benefits

When executing advanced tax strategies, timing is everything. At CCN Business Consulting, we often help business owners and real-estate investors understand how the timing of investments, asset acquisitions, and entity formations can materially impact the availability and magnitude of tax advantages. Two powerful tools often in play: bonus depreciation and the Qualified Small Business Stock (QSBS) rules under Section 1202.

But mastering these tools isn’t just about knowing what they are — it’s about knowing when to act. This blog explores how timing can turn tax-planning from “good” into “great.”

Understanding Bonus Depreciation & QSBS

Bonus Depreciation

Bonus depreciation allows businesses to accelerate the depreciation of qualifying assets, often allowing 100% of the cost to be deducted in the first year (subject to eligibility and phase-outs). The trick is that the rules evolve — Congress amends them, and the effective dates matter.

QSBS (Section 1202)

Section 1202 offers striking tax benefits for investors in qualifying small businesses. If you hold qualifying stock for more than five years, gains can be partially or fully excluded from federal tax — depending on when the stock was acquired, the size of the company, and the nature of the business.

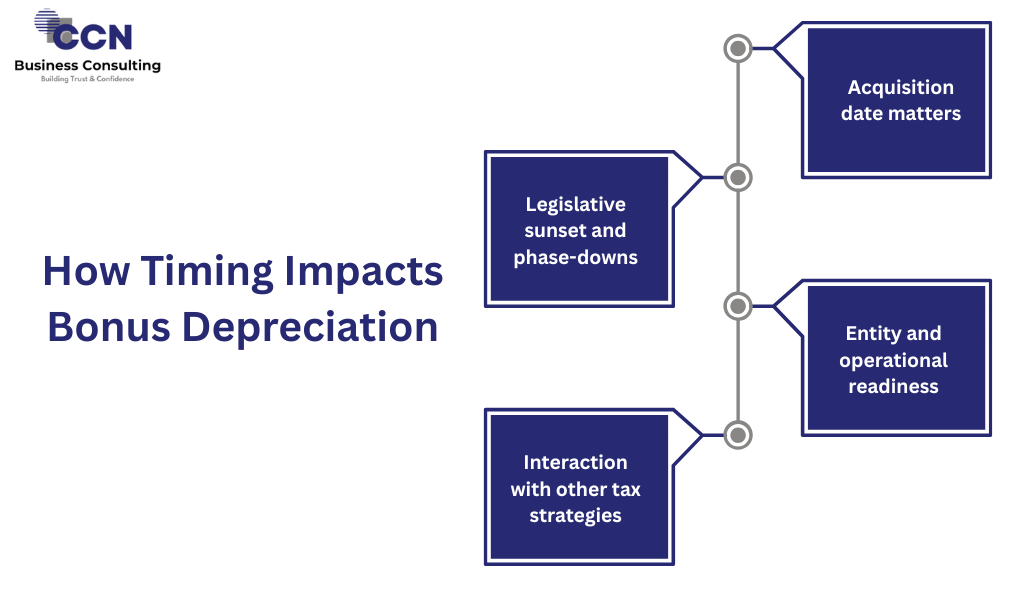

How Timing Impacts Bonus Depreciation

- Acquisition date matters

Depending on when you acquire a qualified asset and when it’s placed into service, you may lock in higher bonus depreciation rates. Delay it too long, and you might lose the optimal deduction amount. - Legislative sunset and phase-downs

Legislation might reduce bonus depreciation percentages or change which assets qualify. Acting before the phase-down can magnify the benefit. - Entity and operational readiness

Even if you acquire an asset, if you don’t place it into service (i.e., ready and operational) in the right tax year, you risk missing the deduction window. - Interaction with other tax strategies

Bonus depreciation can create or increase net operating losses (NOLs) and impact taxable income for the year. Timing can help smooth income, plan for future profits, or align deductions with other strategic events (sale of business, acquisition, etc.).

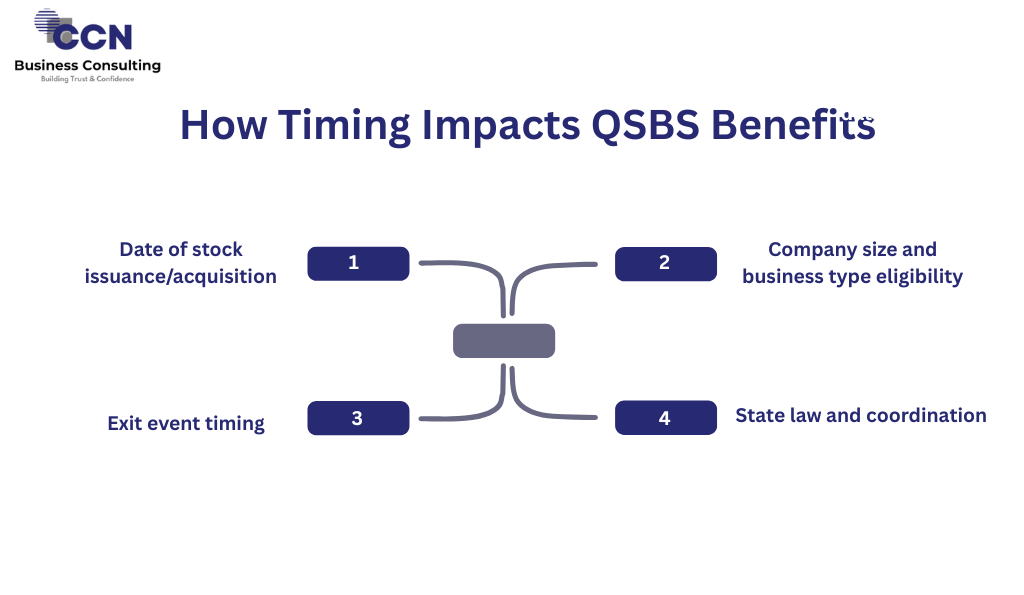

How Timing Impacts QSBS Benefits

- Date of stock issuance/acquisition

Only stock acquired after a certain date and held for more than five years qualifies for the exclusion. Invest too late or exit too early, and you may lose the benefit. - Company size and business type eligibility

The company must meet “small business” thresholds at the time of issuance. Investments made after the business grows beyond size limits may disqualify QSBS treatment. - Exit event timing

If you trigger a sale, merger, or other exit before the five-year holding period (or other QSBS thresholds are met), you forfeit the full exclusion. Planning the timing of the exit is just as important as entering the investment. - State law and coordination

Remember, federal QSBS rules are powerful — but state tax treatment varies. Timing may impact eligibility in states with their own QSBS regimes or none at all.

Why Combining Timing Strategies Matters

When you line up bonus depreciation and QSBS planning together, you gain a strategic edge:

- Acquire assets in a business entity, use bonus depreciation to accelerate deductions, and position the entity growth so that future equity issuances or stock grants qualify as QSBS.

- Think about your exit strategy: timing the sale of business or stock in the optimal year, in tandem with depreciation benefits captured earlier, can enhance after-tax returns.

- Timing funding rounds, acquisitions, and asset placements can all feed into each other: each “clock” starts ticking differently for different tax benefits, and mastering sync can mean substantial outcome differences.

Practical Timing Checklist for Business Owners & Investors

- Review the date and status of assets placed into service — ensure asset readiness aligned with year-end planning.

- Examine your entity’s structure and recent capital issuance — check whether upcoming stock will qualify for QSBS.

- Map anticipated exit events (sale, merger, recapitalization) and work backward to ensure five-year holding period is feasible.

- Revisit your bookkeeping and tax filings now — if you acquired assets this year, ensure operations start in time to hit bonus depreciation.

- Consult a tax-strategy advisor early — the sooner you incorporate timing into the conversation, the more flexibility you’ll have.

Final Thoughts

In tax planning, timing isn’t merely a detail—it’s a strategic lever. Whether you’re acquiring assets to capture bonus depreciation or making equity investments to maximize QSBS exclusion, when you act can matter as much as what you do.

At CCN Business Consulting, we help business owners and investors align operational milestones, investment timing, and exit strategies so that each fits into the optimal tax-planning window. If you’re wondering how your next move impacts timing — it may be time to evaluate strategy rather than simply transactions.