Unlocking Growth: Why You Need Tax Advisory Services in Detroit

Running a business in Detroit today requires more than just managing day-to-day operations. Whether you’re a startup, a mid-sized company, or an established enterprise, the complexity of Michigan’s tax environment can be overwhelming. That’s where Tax Advisory services Detroit comes in — to help you not only stay compliant but also uncover opportunities for growth, efficiency, and strategic savings.

At CCN Business Consulting, we understand that tax management is not just about filing returns. It’s about aligning financial strategy with your business goals and maximizing profitability. Our team provides comprehensive tax advisory solutions that blend technical expertise, financial insight, and industry experience.

What Are Tax Advisory Services?

Tax advisory services involve professional guidance in all aspects of taxation — from planning and structuring to compliance and long-term optimization. Unlike basic tax preparation, advisory services are proactive and strategic. They help you anticipate future liabilities, identify deductions, and structure your operations to minimize tax burdens.

At their core, tax advisory services empower businesses to make informed financial decisions. Whether you’re deciding on a business entity type, planning an acquisition, or managing multiple revenue streams, a skilled advisor ensures that every decision aligns with the most tax-efficient path forward.

The Importance of Tax Advisory Services in Detroit

Detroit’s economic revival has brought immense business opportunities — but also complex tax obligations. Michigan’s state and city-level tax codes, combined with federal requirements, make Detroit a challenging environment for unassisted businesses.

Tax Advisory services Detroit help bridge this gap. By staying ahead of regulatory changes, advisors ensure compliance while helping clients leverage available credits, deductions, and incentives. Whether your company operates in real estate, manufacturing, retail, or professional services, local tax advisory expertise ensures your financial decisions are both compliant and profitable.

The right advisor doesn’t just interpret laws — they translate them into actionable strategies that protect your bottom line.

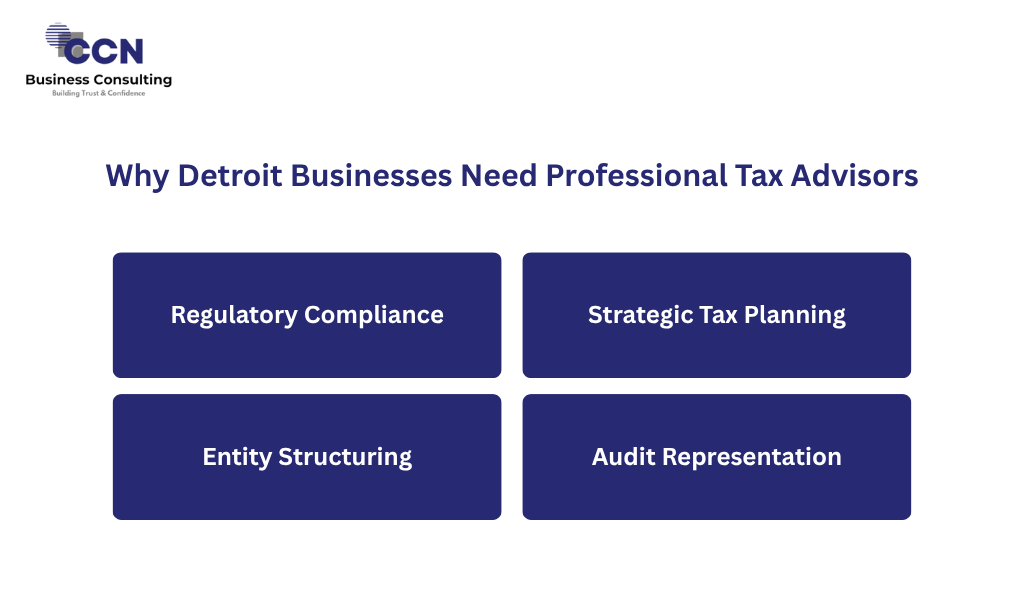

Why Detroit Businesses Need Professional Tax Advisors

Detroit’s business ecosystem is vibrant and diverse. From small businesses in Midtown to large real estate developers downtown, every enterprise faces distinct tax challenges. Engaging a professional firm like CCN Business Consulting ensures you have experts who understand both Michigan’s tax nuances and federal frameworks.

Key advantages include:

- Regulatory Compliance: Staying current with Detroit’s business tax codes and reporting deadlines.

- Strategic Tax Planning: Identifying deductions and credits that can reduce your tax burden.

- Entity Structuring: Choosing the right structure (LLC, S-Corp, C-Corp) to optimize taxation.

- Audit Representation: Defending your financial position confidently if audited by tax authorities.

Professional advisors help you view taxes not as an annual obligation, but as a continuous part of your growth strategy.

What Makes CCN Business Consulting Stand Out

At CCN Business Consulting, our mission is to help clients gain full financial clarity. We combine decades of tax expertise with a practical understanding of Detroit’s evolving business landscape.

What sets us apart is our integrated advisory model — we go beyond tax compliance to align your accounting, strategy, and business planning. Whether you’re a real estate investor or a business owner seeking financial control, our experts craft a tax strategy tailored to your long-term goals.

Our services cover tax planning, accounting, and Fractional CFO consulting — creating a 360° financial support system for your business.

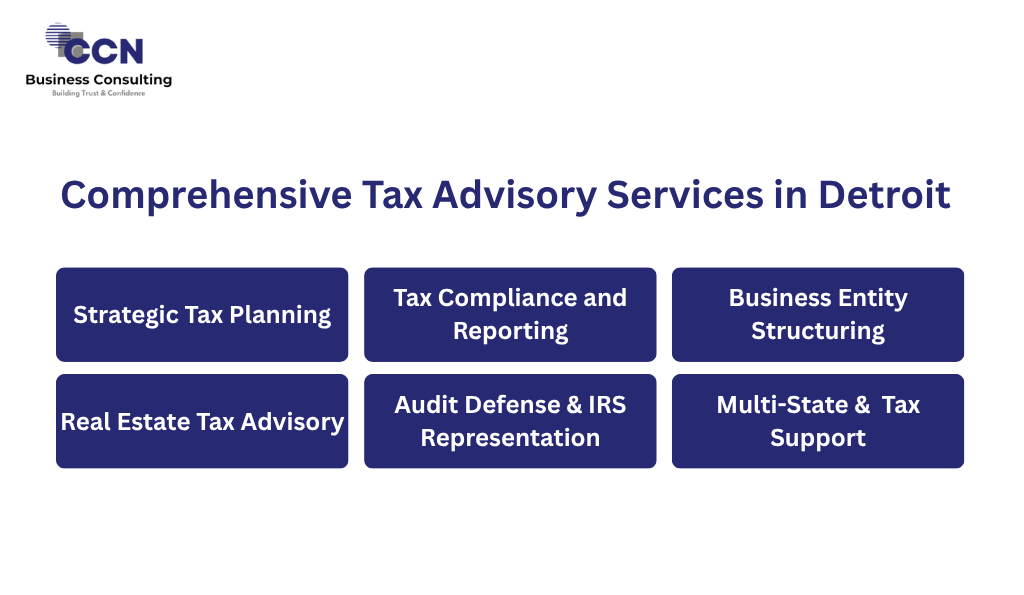

Comprehensive Tax Advisory Services in Detroit

When it comes to Tax Advisory services Detroit, businesses need a partner who provides both breadth and depth. At CCN Business Consulting, we offer end-to-end tax solutions, including:

1. Strategic Tax Planning

We assess your finances to identify deductions, credits, and restructuring opportunities. Our team helps you time income and expenses, plan capital investments, and optimize your tax position throughout the year — not just at tax season.

2. Tax Compliance and Reporting

Accuracy and timeliness are vital. We handle federal, state, and local filings to ensure full compliance with Michigan and Detroit tax regulations. Our compliance process minimizes risk and prevents costly errors that could trigger audits.

3. Business Entity Structuring

The structure of your business defines your tax obligations. Whether you’re forming a new company or reorganizing, we help you choose between LLCs, corporations, and partnerships — selecting the best structure to minimize liability and maximize benefits.

4. Real Estate Tax Advisory

Detroit’s real estate market is booming. Our advisors help investors navigate depreciation, cost segregation, 1031 exchanges, and capital gains planning — ensuring optimal tax treatment for each property transaction.

5. Audit Defense & IRS Representation

Facing a tax audit can be stressful. Our experts represent your interests before the IRS or Michigan Department of Treasury, ensuring a smooth resolution and mitigating penalties.

6. Multi-State Tax Support

For businesses operating across states or borders, our team ensures compliance with diverse tax jurisdictions. We manage income apportionment and cross-border tax planning.

These services are designed to give Detroit businesses the confidence and clarity they need to focus on growth — not paperwork.

Detroit’s Tax Environment: A Closer Look

Detroit’s resurgence as a commercial hub has also made its tax environment increasingly complex. Businesses must navigate:

- Michigan Corporate Income Tax (CIT) — applicable to corporations with Michigan nexus.

- Detroit Income Tax — separate local taxation for residents and businesses.

- Property Taxes — significant for real estate owners and developers.

- Incentive Programs — opportunities like Detroit’s Renaissance Zone credits or state-level abatements.

Without expert guidance, many businesses miss out on potential tax savings. With CCN Business Consulting’s Tax Advisory services Detroit, you can identify these opportunities early and integrate them into your annual financial strategy.

The CCN Business Consulting Approach to Effective Tax Advisory

At CCN Business Consulting, we follow a proven process that ensures both accuracy and strategy:

- Discovery & Analysis – We begin by understanding your financial structure, goals, and current compliance status.

- Strategic Planning – Next, we design a personalized tax plan that aligns with your operations and long-term vision.

- Implementation – Our team executes the plan, ensuring documentation, filing, and follow-through.

- Continuous Monitoring – We track law changes and business shifts, updating your strategy as needed.

This ongoing advisory model transforms tax management from a once-a-year task into a continuous optimization effort.

Common Tax Challenges Faced by Detroit Businesses

Even the most well-managed companies encounter tax challenges. Some common issues include:

- Misclassification of expenses leading to missed deductions.

- Failure to leverage state or local credits.

- Incorrect entity structuring resulting in overpayment.

- Lack of documentation during audits.

- Misalignment between accounting practices and tax strategies.

Our experts identify and correct these issues through careful analysis and long-term tax planning. Visit our Services page to see how we tailor our approach for each client.

Benefits of Professional Tax Advisory Services

Partnering with CCN Business Consulting delivers measurable benefits:

- Maximized Savings: Reduce liabilities through legal, strategic planning.

- Reduced Risk: Avoid penalties through error-free compliance.

- Informed Decisions: Gain insights to support expansion, investment, and restructuring.

- Operational Efficiency: Let professionals handle complex filings while you focus on growth.

- Future-Ready Strategy: Adapt quickly to regulatory or financial changes.

Effective tax advisory isn’t an expense — it’s an investment in the financial health and sustainability of your business.

Integrating Tax Advisory With Accounting & Fractional CFO Services

What makes CCN Business Consulting uniquely effective is our integrated financial approach. Our Accounting Services ensure accurate records and clear reporting, while our CFO consulting adds strategic oversight to every financial decision.

When combined with Tax Advisory services Detroit, this trio of solutions forms a robust financial backbone for your business. It allows us to connect daily financial operations with big-picture strategy, improving decision-making and profitability.

Case Example: Tax Advisory in Action

A mid-sized construction company in Detroit approached CCN Business Consulting facing recurring tax penalties and inconsistent cash flow. After conducting a full tax and accounting review, our advisors identified unclaimed credits, adjusted entity classification, and developed a quarterly planning system. Within a year, the company reduced tax liability by 15% and stabilized its budget forecasts.

Such results showcase how proactive advisory can transform business outcomes — not just compliance.

Choosing the Right Tax Advisory Partner in Detroit

Selecting the right partner is crucial. Here’s what to look for:

- Local Expertise: Deep understanding of Michigan and Detroit tax laws.

- Proven Track Record: Experience across industries and company sizes.

- Holistic Approach: Integration of tax, accounting, and financial strategy.

- Transparency: Clear communication and predictable pricing.

- Client-Centric Mindset: Advisors who treat your business as their own.

At CCN Business Consulting, we pride ourselves on delivering personalized, transparent, and impactful tax solutions for Detroit businesses.

Why Businesses Trust CCN Business Consulting

Our clients trust us because we combine professional precision with personalized care. Every engagement begins with a detailed understanding of your business model, risk tolerance, and future goals.

Whether you’re restructuring, expanding, or simply aiming to stay compliant, our Detroit tax advisors ensure every decision adds value. Explore our About Us page to learn more about our mission, values, and leadership team.

Stay Informed: Explore Our Latest Insights

We regularly publish expert insights, updates, and financial tips in our Blogs. From IRS updates to Michigan business tax news, our content keeps you ahead of the curve. Bookmark the page to stay informed and empowered year-round.

Get Started with CCN Business Consulting Today

Your business deserves proactive, informed, and strategic tax guidance. With Tax Advisory services Detroit from CCN Business Consulting, you gain more than compliance — you gain a partner in financial growth.

Let us help you unlock the full potential of your business through smart tax planning, accurate reporting, and year-round advisory.