Professional Tax Services Memphis: A Complete Guide for Businesses & Individuals

Running a business in Memphis, Tennessee, comes with incredible opportunities but also financial challenges. Whether you’re a small business owner, an independent contractor, or managing a growing company, taxes can feel overwhelming. From understanding complex IRS regulations to maximizing deductions, it’s easy to miss out on savings or run into compliance issues. That’s where Professional Tax Services Memphis TN make a difference. At CCN Business Consulting, we help businesses in Memphis streamline their finances, reduce tax burdens, and stay compliant year-round.

In this blog, we’ll explore why professional tax services are essential, the benefits they bring, and how our team at CCN Business Consulting provides tailored solutions for Memphis businesses.

Why Professional Tax Services Matter in Memphis TN

Taxes are not just about filing returns once a year. They involve ongoing planning, compliance, and strategic financial management. Memphis is home to a vibrant mix of industries—healthcare, logistics, real estate, and retail—all of which face unique tax requirements. A professional tax consultant ensures you meet deadlines, claim eligible deductions, and avoid costly mistakes.

Choosing Professional Tax Services Memphis TN means you’re investing in peace of mind. Instead of worrying about IRS audits or penalties, you can focus on growing your business. Professional tax experts keep up with state and federal regulations, which change frequently, so you don’t have to.

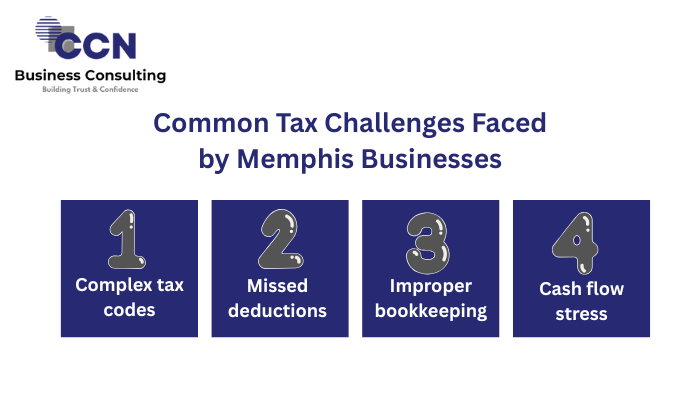

Common Tax Challenges Faced by Memphis Businesses

Even the most organized businesses run into tax challenges. Some of the most common issues include:

- Complex tax codes – Federal and Tennessee tax laws are constantly updated, making it hard to stay compliant without guidance.

- Missed deductions – Many business owners lose thousands each year by not claiming all eligible deductions.

- Improper bookkeeping – Disorganized financial records can lead to filing errors and IRS penalties.

- Cash flow stress – High tax liabilities can disrupt business operations if not planned in advance.

This is where our Professional Tax Services Memphis TN help. With accurate bookkeeping, tax planning, and compliance support, we ensure you avoid these pitfalls. (Related: Explore our Bookkeeping Services in Detroit for seamless financial record-keeping.)

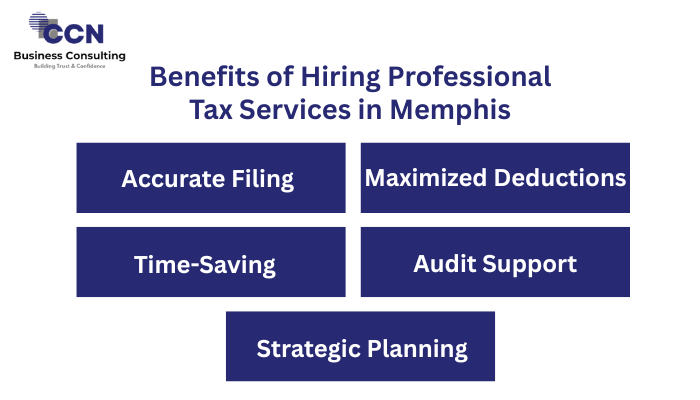

Benefits of Hiring Professional Tax Services in Memphis

Working with a tax professional goes beyond filing returns. Here’s how it helps:

- Accurate Filing – Professional tax experts ensure error-free submissions to avoid audits.

- Maximized Deductions – From office expenses to employee benefits, we help you claim what you deserve.

- Time-Saving – Instead of spending days on tax paperwork, you can focus on business operations.

- Audit Support – If the IRS reviews your return, having a professional on your side is invaluable.

- Strategic Planning – With proactive tax strategies, you reduce liabilities and improve profitability.

At CCN Business Consulting, we don’t just prepare taxes—we create a roadmap for your financial growth.

Professional Tax Services Memphis TN for Individuals

Not only businesses but also individuals in Memphis benefit from professional tax assistance. If you’re a freelancer, contractor, or salaried employee with investments, tax filing can get complicated. Our services include:

- Individual tax preparation

- Tax Planning

- IRS problem resolution

- Quarterly Estimated Tax Calculations

By choosing our team, you get clarity on how to minimize personal tax burdens while staying compliant.

Professional Tax Services Memphis TN for Small Businesses

Memphis is full of thriving small businesses, from restaurants on Beale Street to tech startups. Each one faces unique tax situations. Our services for small businesses include:

- Quarterly estimated tax calculations

- Payroll tax management (linked with our Payroll Services)

- Business deductions and expense tracking

- Tax compliance for LLCs, corporations, and partnerships

We understand that small business owners wear multiple hats. That’s why outsourcing tax services saves both time and money, letting you focus on customers instead of forms.

Professional Tax Services Memphis TN for Corporations

Large corporations in Memphis deal with multi-state operations, employee benefits, and extensive compliance requirements. Mistakes can lead to huge financial consequences. Our corporate tax services include:

- Federal and Tennessee corporate tax return preparation

- Multi-state and international tax compliance

- Employee benefits and payroll tax optimization

- Strategic tax planning for mergers, acquisitions, and expansions

By working with CCN Business Consulting, corporations in Memphis gain access to experienced tax consultants who align tax strategies with long-term growth.

The Role of Bookkeeping in Tax Accuracy

A strong tax strategy begins with accurate bookkeeping. Without organized records, even the best tax consultant can miss opportunities. At CCN Business Consulting, we combine Bookkeeping, Payroll, and Tax Services into one seamless system.

Our bookkeeping team ensures all transactions, receipts, and expenses are properly categorized. This makes tax filing faster, more accurate, and less stressful. Businesses using our integrated approach often see a 20–30% improvement in tax savings simply because nothing slips through the cracks.

How CCN Business Consulting Stands Out in Memphis TN

Memphis has many accountants and tax preparers, but CCN Business Consulting brings a unique approach:

- Personalized service – We take time to understand your business, not just your numbers.

- All-in-one financial solutions – From bookkeeping to payroll to tax planning, we cover it all.

- Proactive strategies – We don’t just file taxes; we help you plan ahead.

- Local expertise – Based in the U.S., we understand both Tennessee laws and federal regulations.

When you search for Professional Tax Services Memphis TN, you want a partner who knows your city, your industry, and your challenges. That’s exactly what we provide.

Why Memphis Businesses Trust CCN Business Consulting

We’ve helped countless Memphis businesses simplify their tax processes. Our clients often share how our guidance saved them thousands of dollars annually while reducing stress.

For example, a logistics company in Memphis was struggling with payroll tax compliance. By working with CCN Business Consulting, they not only avoided IRS penalties but also discovered tax credits they hadn’t been claiming.

Success stories like these prove why professional tax services are a long-term investment, not an expense.

Steps to Get Started with Professional Tax Services Memphis TN

Getting started with our tax services is simple:

- Schedule a Consultation – We learn about your business and financial goals.

- Review Financial Records – Our team examines your books, payroll, and past returns.

- Develop a Tax Strategy – We create a personalized plan for compliance and savings.

- Ongoing Support – From quarterly filings to IRS correspondence, we’ve got you covered.

It’s that easy. Our mission is to make taxes stress-free for Memphis businesses and individuals.

Final Thoughts

Taxes don’t have to be stressful. With the right partner, they can become a powerful tool for business growth. At CCN Business Consulting, we provide Professional Tax Services Memphis TN designed to save you time, reduce liabilities, and maximize profitability. Whether you’re an individual, a small business, or a corporation, our team is here to help you succeed.

Ready to simplify your taxes? Visit CCN Business Consulting today and schedule your free consultation.